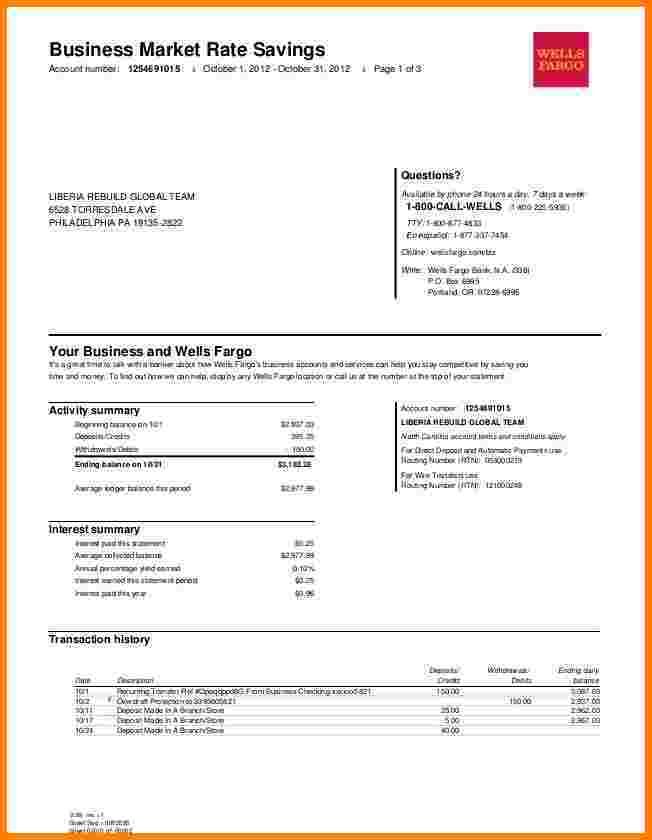

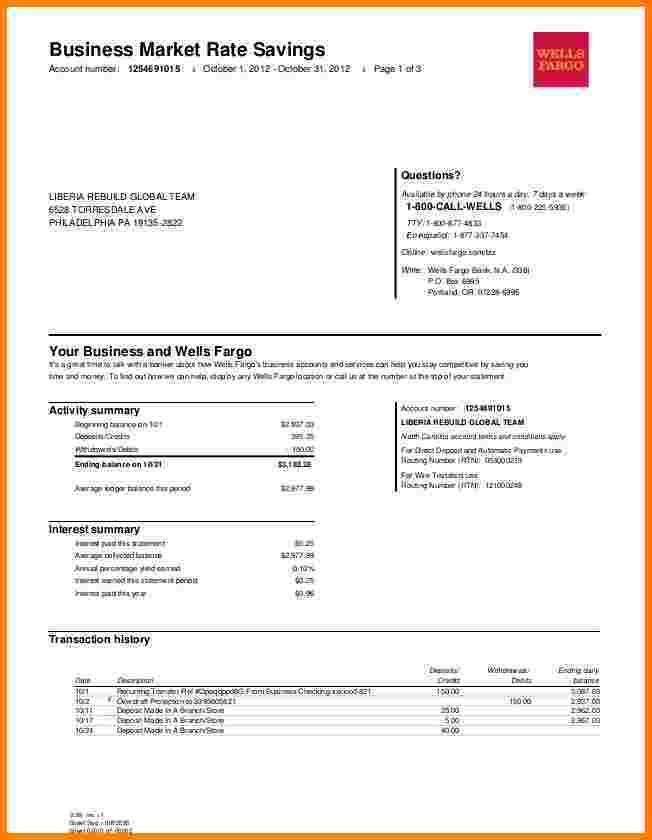

Skip to the content. Search. Business Bank Statement Loan.A bank statement is a report usually delivered monthly that shows you deposits, withdrawals, fees paid and Refinance your auto loan How to pay for college How to get a business loan Student loan A bank statement is a monthly document that shows you a summary of the money that goes in and out.The reported financial statements for banks are somewhat different from most companies that investors analyze. The primary business of a bank is managing the spread between deposits that it pays consumers and the rate it receives from their loans.

These business loans do exist, and they can be a huge asset to small business owners. In this guide, we’ll walk through all the no doc business loans Some merchant cash advance companies might require you to sync your bank statements or your credit card processing statements just to get a.Bank statement loan programs typically require that you meet complicated criteria like having a certain debt service coverage ratio (this is the cash flow you have available to pay your debt, including the interest rate) or liquidity ratio (this is used to determine if your business is able to pay off its debts).

Banks use the individual’s bank statements and other credit documents to analyze the creditworthiness of the borrower. It applies to most types of loans, including residential mortgagesMortgageA mortgage is a loan – provided by a mortgage lender or a bank – that enables.