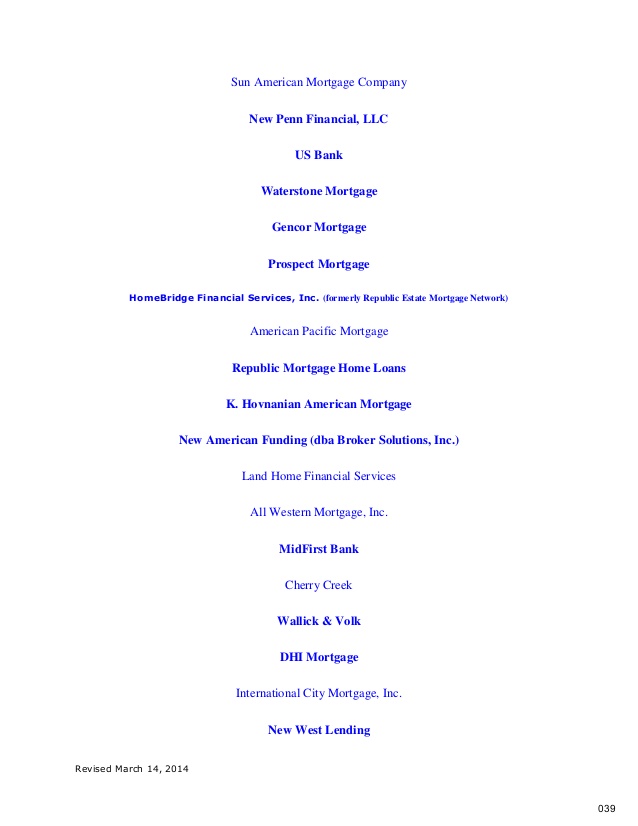

MidFirst Bank has a Capitalization of 6.33% versus the BestCashCow average of 12.68. Capitalization measures how much equity capital a bank has to underpin loans and other assets on its balance sheet.It was owned by several entities, from MidFirst Bank to MidFirst Bank of MidFirst Bank, it was hosted by MIDFIRST BANK, Incapsula Inc and others. While REGISTER.COM INC. was its first registrar.2019 IDFC FIRST Bank. All rights reserved. Site best viewed in Chrome 45, Firefox 39, IE 11, Safari 5.MidFirst Bank provides banking services. The Bank offers savings, loans, deposits, cards, mortgages, securities trading, payment transfers, real estate lending, accounts checking, money.

MidFirst Bank is a privately held bank offering a range of personal, commercial, trust, and mortgage MidFirst Bank is offering a $250 bonus when you open a new Business Checking account with them.Find the latest listing of MidFirst Bank promotions, bonuses, and offers here. Earn a $150 or $250 bonus for opening a new 3 MidFirst Bank $150 Checking Bonus. 4 Checking Account Bonuses.153 reviews from MidFirst Bank employees about MidFirst Bank culture, salaries, benefits, work-life balance, management, job security, and more. MidFirst Bank. Happiness rating is 52 out of 10052.MidFirst Bank – Online Personal & Business Banking, Credit Cards, Auto & Home Loans Midfirst bank is located in Overland Park city of Kansas state. On the street of Johnson County Community.

Pay your MidFirst Bank bill online with doxo, Pay with a credit card, debit card, or direct from your bank account. doxo is the simple, protected way to pay your bills with a single account and.Current and historial financial information of MidFirst Bank as well as the rankings in U.S. MidFirst Bank Financial Information. # of Branches: 81, ranked #109.MidFirst Bank offers a full range of personal, commercial, trust, private banking and mortgage MidFirst is a commercial real estate lender and a major servicer of mortgage loans nationally.MidFirst Bank offers an array of personal accounts and services designed for individuals and families. Choose from checking and savings accounts, CDs and IRAs, loans, bankcards and investment.

Learn how Midfirst Bank is rated and compare its account fees, customer reviews, and latest bank accounts interest rates. Find out if it’s worth opening up an account with this bank.Thank you for choosing MidFirst Bank. Our online loan application makes it easy for you to apply for a loan at your convenience.See more of MidFirst Bank on Facebook. MidFirst Bank offers a full range of personal, commercial, business, trust, wealth management, priva.MIDFIRST BANK Bank Name:MidFirst Bank Bank Class:Savings & Loan Association MidFirst Bank was founded in February 1911 and is based in Oklahoma City, Oklahoma.

MidFirst Bank offers a full range of personal, business, commercial, trust, private banking and MidFirst is a strong commercial real estate lender and a major servicer of mortgage loans nationally.Where is MidFirst Bank located? MidFirst Bank is located at United States, Phoenix, 411 N Central Ave, Ste 140.MidFirst Bank is privately held financial institution based in Oklahoma City. Its primary markets include Oklahoma City, Tulsa, western Oklahoma, Denver, Phoenix and Dallas, with commercial lending offices in Atlanta, Boston, Chicago, Cleveland, Houston, New York City, St. Louis and Southern California.Practice 27 MidFirst Bank Interview Questions with professional interview answer examples with advice on how to answer each question. With an additional 54 professionally written interview answer.

Read our in-depth review of MidFirst Bank, which offers robust service offerings, including checking and savings accounts, mortgages, personal loans, CDs and more.169 MidFirst Bank reviews. A free inside look at company reviews and salaries posted anonymously by employees. Midfirst bank truly cares about their employees and will give further training if need be.MidFirst Bank offers all the traditional deposit accounts options – Checking, Savings, Money Market, CD and IRA accounts. Their eChecking account has some rates that may be worth looking over.MedPro Loans. We have mortgages tailored specifically to health professionals. Our MedPro Loan Program is a residential mortgage loan developed specifically for physicians, dentists, optometrists.