Cryptocurrency is quickly gaining in popularity. But it can be difficult to decide which cryptocurrency exchange is best for you.

If you’re looking for a secure platform that allows you to make cryptocurrency purchases with a credit card, then Paybis could be the right spot.

But Paybis may not be the best choice if keeping costs to a minimum is your top priority. Let’s take a closer look at Paybis to help you decide if it might be the right cryptocurrency exchange for you.

Quick Summary

- Allows credit card crypto purchases

- 10 supported cryptocurrencies and 47 fiat currencies

- The platform is UK, EU, and USA compliant

Paybis Details | |

|---|---|

Product Name | Paybis |

Supported Currencies | 10 |

Payment Methods | Bank transfer, debit card, credit card |

Transaction Fee | 0.99% to 2.49% |

Card Processing Fee | 4.5% (minimum of $10) |

Promotions | Transaction fee waived on first trade |

What Is Paybis?

Paybis was founded in 2014 by Innokenty Isers and Konstantin Wasilenko. The goal of the platform was to create a place to buy and sell the top cryptocurrencies in an extremely secure environment.

Since its founding seven years ago, Paybis has built a reputation of trustworthiness in the world of cryptocurrency. The company is currently operating in more than 180 counties and has an annual trading volume of over $250,000,000.

What Does It Offer?

Let’s explore what Paybis can offer you as a user.

Support For Credit Card Purchases

Paybis heavily advertises that it allows users to buy crypto with a credit card or debit card (in addition to supporting bank transfer transactions).

While debit card support is far from unusual in the cryptocurrency industry, credit card support is less common. For example, Coinbase and Gemini allow debit card purchases but both don’t allow U.S. users to purchase crypto with a credit card.

Limited Menu Of Cryptocurrencies

As of writing, the Paybis platform only supports 10 cryptocurrencies. Thankfully, the 10 that are supported are all some of the most popular. Here’s the list:

- Bitcoin

- Ethereum

- Tether

- Litecoin

- Ripple

- Bitcoin Cash

- Stellar Lumens

- Binance Coin

- Tron

- Dogecoin

Long List Of National Currencies

In addition to the 10 cryptocurrencies listed above, Paybis supports 47 fiat currencies. This could help many of its users reduce their currency exchange costs.

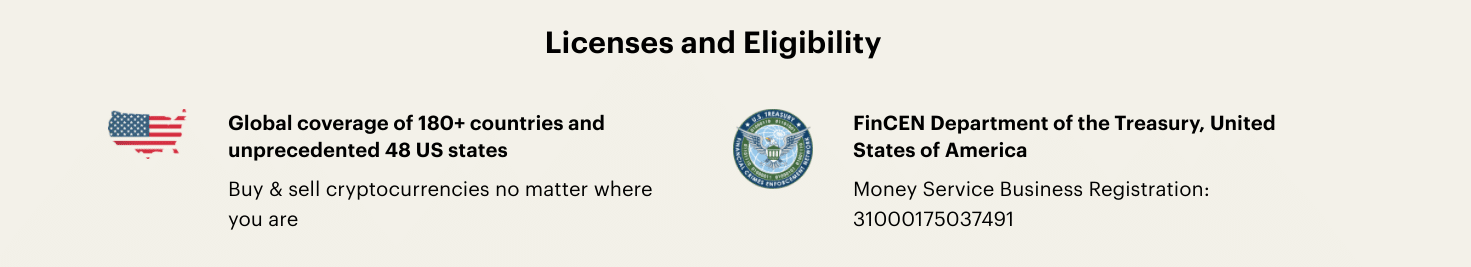

Coupled with the fact that the exchange is available in 180+ countries, Paybis could be a great option for international crypto investors or those who travel frequently.

Speedy Security Checks

Security checks that verify your identity can be tedious and time-consuming. But not with Paybis. Although you’ll have to upload supporting documents that verify your identity, you shouldn’t have to wait too long to get up and running. Paybis says that its verification process usually only takes about 15 minutes.

A Commitment To Trust

Throughout its life as a company, Paybis has constantly worked to abide by the strictest security and legal standards surrounding cryptocurrency.

Currently, the company is registers and regulated by the Financial Conduct Authority, a UK regulatory agency. Paybis is also registered with the Financial Crimes Enforcement Network (FinCEN) with licenses to operate in 48 states within the U.S.

Are There Any Fees?

Any cryptocurrency platform will have fees associated with your transactions. And Paybis is no exception. You’ll be charged up to three types of fees for every transaction.

The first fee is the transaction fee (also called the “Paybis Fee”). In mid-2021, Paybis lowered its cryptocurrency purchase processing fee from 2.99% to 0.99% for ACH transactions. But for card transactions, the Paybis fee is 2.49%. This fee is waived for your first trade.

The second fee is the card processing fee for debit/credit credit transactions. This fee is 4.5% in the U.S. (up to 6.5% in other countries) and there is a minimum card processing fee of $10. Third, you’ll pay a miner’s fee which varies by currency.

When you add the Paybis fee for cards (2.49%) and card processing fee (4.5%) together, you find that you’re actually paying 6.99% for card transactions (before the miner’s fee). That’s very high. So unless you really feel compelled to buy crypto with a credit card, we don’t recommend making card purchases with Paybis.

How Does Paybis Compare?

In terms of the sheer number of cryptocurrencies available, you can find more options through other platforms like Coinbase and Gemini. Paybis sets itself apart by supporting credit card purchases. But it also charges more for card transactions and has a high $10 minimum fee.

Paybis does have lower ACH transaction fees than the standard Coinbase and Gemini platforms. However, it should be noted that both of those exchanges have separate active trader platforms that have more affordable maker/taker fee structures. With Paybis, there’s no such advanced platform that offers lower fees.

Header |  |  | |

|---|---|---|---|

Rating | |||

Fees | Up to 6.99% | Up to 4.5% | Up to 3.99% |

Supported Currencies | 10 | 90+ | 45+ |

Credit Cards | |||

Custody Service | |||

Cell | Cell |

How Do I Open An Account?

Before you can work with Paybis, you’ll need to be at least 18 years old, live in an authorized area, accept Paybis’ terms of service and have a crypto wallet.

The last requirement of having a crypto wallet is very important. That’s because Paybis is a non-custodial cryptocurrency exchange. So you’ll need to place the currencies you buy into a crypto wallet. Need help finding one? Here’s a list of the best cryptocurrency wallets out there.

Once you have everything set up, you can start the process of setting up an account. To get started, you’ll need to provide information to verify your identity. These documents can include a government-issued identity card, a selfie with an indemnification document, a bank statement, a selfie with a credit card.

It may take as little as 15 minutes to complete the identity verification process. But it could take up to 24 hours. Once your identity is verified, you can access all of the features that Paybis has to offer.

Is It Safe And Secure?

Paybis offers a very secure and highly regulated environment for your cryptocurrency purchases. With strict KYC regulation enforcement and extensive identity verification steps, Paybis sets the stage for a reputable platform.

Additionally, the website offers secure encryption to complete transactions. Finally, Paybis doesn’t hold any of your purchased cryptos. Instead, you’ll store the crypto in your own crypto wallet. So you won’t have to worry about Paybis losing any of your funds due to a hack or server failure.

How Do I Contact Paybis?

Paybis makes it easy to get in contact with them. You can reach out via email at support@paybis.com. Additionally, you can make contact through the live chat feature or the support portal on their website.

Finally, you can connect with Paybis via Youtube or Twitter @Paybis. We weren’t able to find a customer service phone number on the site.

Customer Service

Not all cryptocurrency exchanges are known for top-notch customer service. But despite not having a phone line, Paybis seems to stand apart from the crowd in this regard. It offers 24/7 live chat support to walk you through any questions that arise.

On Trustpilot, Paybis has earned 4.4 out of 5 stars with over 14,000 reviews. So based on the overwhelmingly positive reviews, it seems that their customer support team is not just available but also extremely responsive and attentive to any issues that arise.

Is It Worth It?

Paybis could be worth considering if you’re a long-term cryptocurrency investor in popular currencies like Bitcoin or Ethereum and you really want to use a credit card to buy them. It could also be a worthwhile option for buying crypto via ACH as its transaction fee for bank transfers is reasonable.

However, you’ll need to look elsewhere if you’re hoping to invest in a slightly lower-volume currency like Dai or Tezos. Also, if you trade multiples times per day or week, you’ll want to look for a platform that uses a maker/taker fee structure instead.

Most of the platforms that are geared towards active traders charge maker/taker fees that never exceed 0.50%. Meanwhile, even Paybis’ lowest-cost payment method (ACH) will cost you 0.99%. So, at the very least, you could cut your costs in half by choosing a trader-centric platform instead of Paybis. Check out our favorite crypto trading sites here >>>

Paybis Features

Supported Cryptocurrencies |

|

Supported Fiat Currencies | 47 |

Transaction Fee |

|

Card Processing Fee | * Up to 6.5% for currencies other than USD, EUR, and GPB |

Network Miner’s Fee | Varies by currency |

Withdrawal Fee | N/A |

Custody Service | No |

Supported Countries | 180+ |

Customer Service Options | Live chat, email |

Customer Service Hours | 24/7 |

Customer Service Email | support@paybis.com |

Web/Desktop Account Acces | Yes |

Mobile App Availability | iOS |

Promotions | Transaction fee waived on first trade |