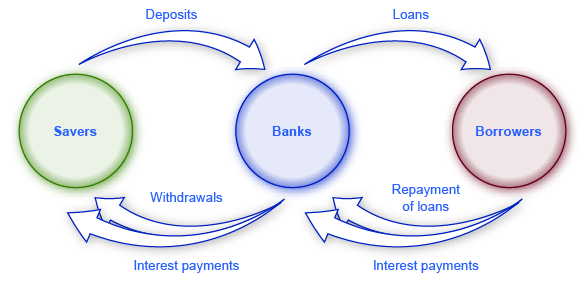

When banks lend out money, that money is created out of thin air by a accounting journal entry, and the money supply I think a bank loan is when money is borrowed from a bank with the expectation that it will be repaid, and notes payable is then the accumulation of all loan amounts expected to be.The supply of money, on the other hand, is the actual amount in notes and coins available for business purposes. The banks provide a service here through supplying foreign currency, travellers cheques and eurocheques, together with advice on your trip.When the Fed wants to increase money supply, it starts buying bonds. It takes the bond in Raising the reserves reduces money supply because the banks can’t lend a whole lot of the You can figure out what happens to the money supply and then you’re going to see how that affects the interest rate.The purpose of a bank is to the make the owners money. But unlike every other business model out there, banks are the only ones So they lent out 90% of your money, or $9,000 as a loan to Frank at a 5% interest rate All of a sudden, Frank has $9,000 to spend, you still have your $10,000 and what.

The bank then uses the money that has been deposited to grant loans – lend As the process continues, the banking system can expand the first deposit of $ 100 into nearly $1,000. This changes the balance of supply – how much is being sold – and demand – how much is being bought.11. When a bank loans out $1,000, the money supplya.does not change.b.decreases.c.increases.d.may do any of the above.ANS:C2. 12. Which of the following does the Federal Reserve not do?13. An open-market purchase14. If the reserve ratio is 10 percent, $1.How to borrow money with a bank loan. “Taking out a personal loan to pay down high-interest credit card debt can boost your credit score by lowering your credit utilization ratio,” says Young. The terms of the loan are in months and can range from 12 to 96 months. When you complete the loan.When a bank loans out $1,000, the money supply. Suppose that banks do not hold excess reserves. If the required reserve ratio is 5 percent (or 5/100 = 1/20 as a fraction) and a bank receives a new deposit of $1,000, then this bank.

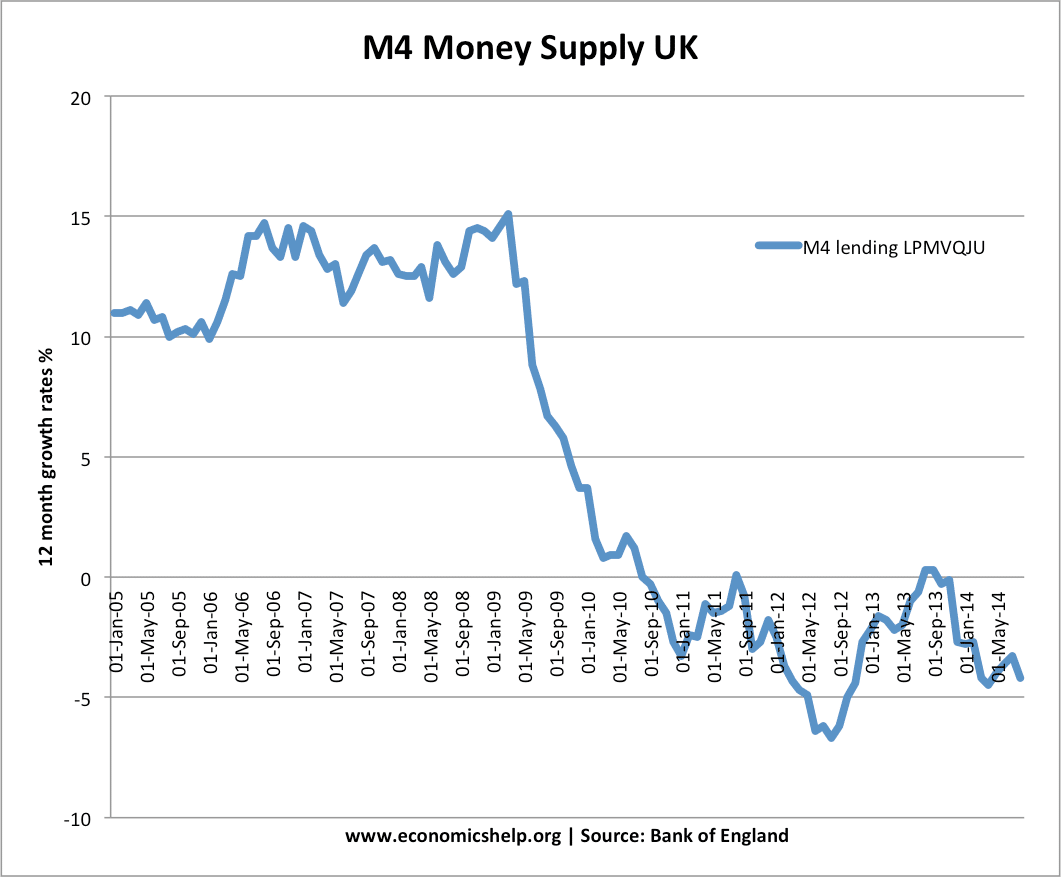

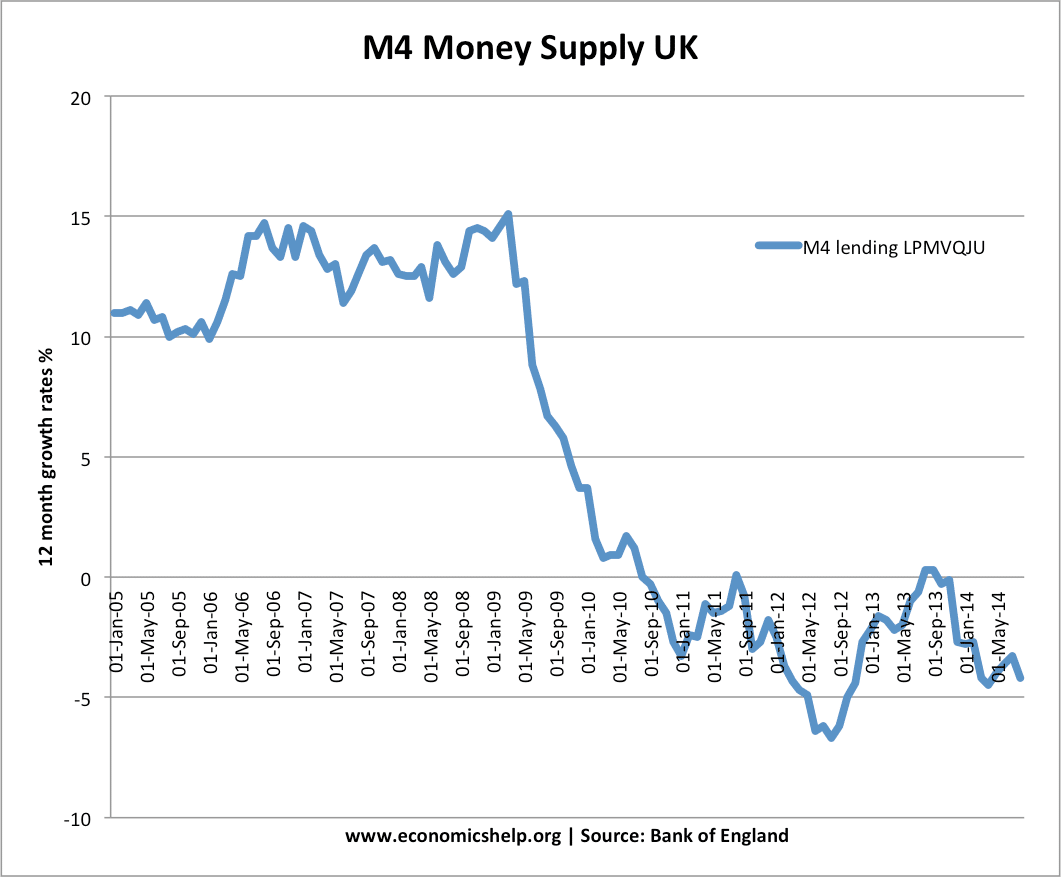

Money Supply 1. Who affects the money supply? % reserve banking 3. Fractional reserve banking 4. Money Supply determination and the money multiplier 5. What causes money supply to change? Then bank loans out $ (1-r)*D. If say r = 20%, then reserves R = 20% of $1000 = $200.Banks normally receive money from their customers in two distinct forms: on current account, and on deposit account. The bank is a reservoir of loanable morney, with streams of money flowing in and out.When a bank loans out $1,000, the money supply a. does not change. b. decreases. c. increases. d. may do any of the above. The Fed can decrease the money supply by conducting open-market a. sales or by raising the discount rate. b. sales or by lowering the discount rate. c. purchases or by.The central bank acts as banker to the commercial banks and supervises and regulates not only the banking system but also the financial sector. As banker to the government it takes responsibility for the control of the money supply and the funding of the government’s budget deficit.

Decreases Increases. May Do Any Of The Above.The bank makes money when people miss a payment, and they get to add on all of the accrued interest to the loan. The 0% is for a certain time As well, banks are allowed to loan out money they receive multiple times to other people as it gets paid back – for example, after I pay back $1,000 to the.The money supply is all the currency and other liquid instruments in a country’s economy on the date measured. Bank regulators influence money supply available to the public through the requirements placed on banks to hold reserves, how to extend credit and other regulation.When the bank makes a loan, it will generally be for some length of time. If it lends Snavely Lumber $40,000 to buy a new forklift, the loan might have a term of five The second kind of liabilities we use as money are the liabilities of commercial banks. Suppose you have $1,000 in your checking account.